Hold onto your hats, ladies and gentlemen, as we delve into the latest decision from the venerable Bank of England. It's not every day that the central bank rolls the dice with the economy, but here we are with the fresh-off-the-press announcement that the Bank Rate has been reduced from 5.25% to 5.0%.

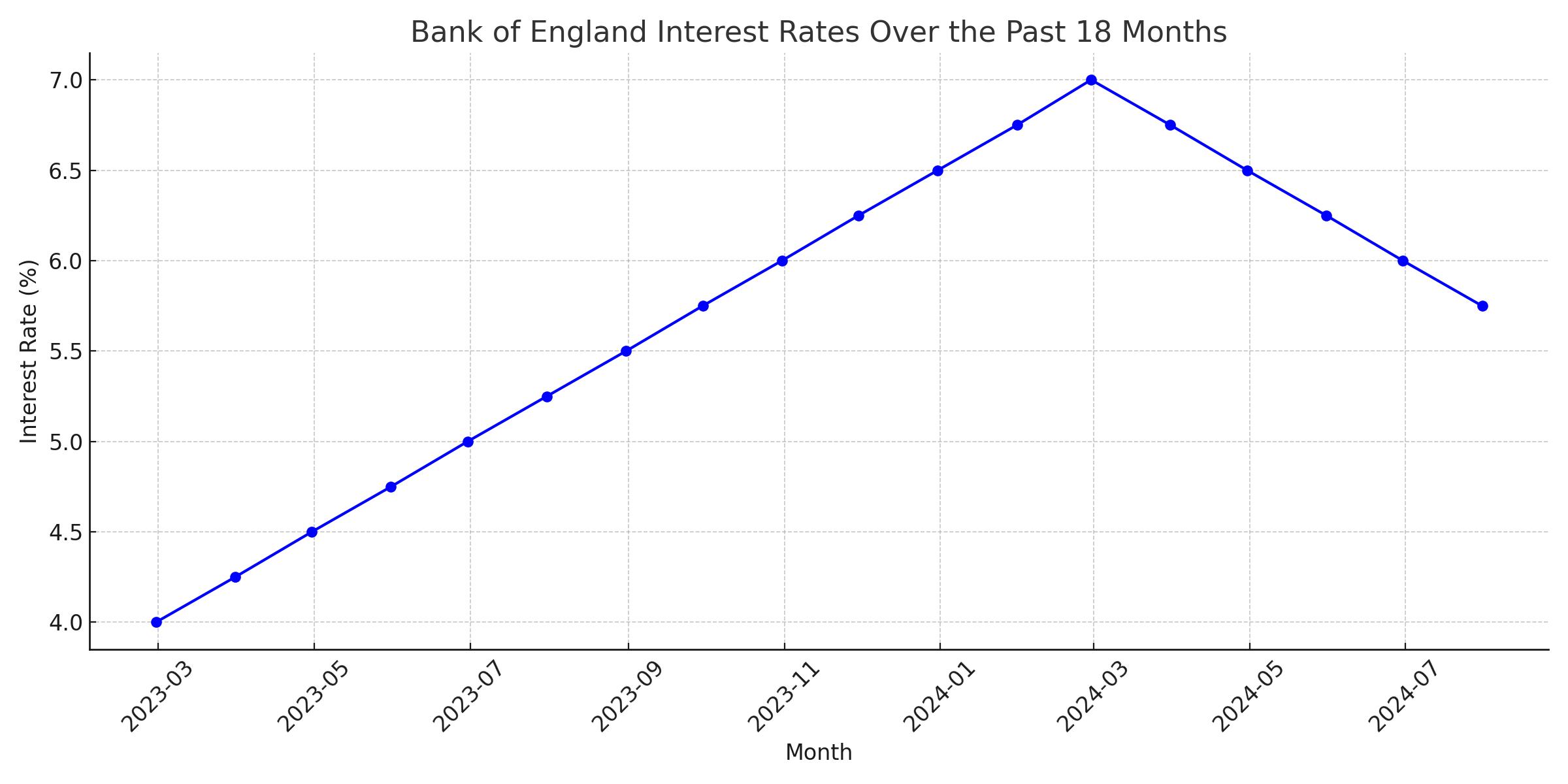

The Bank of England's Monetary Policy Committee (MPC) has been working tirelessly to keep inflation in check while balancing the need for economic growth. In August 2024, the Committee made a bold move to cut the interest rate by 0.25%, citing a softer domestic economic outlook and the fading effects of previous external shocks.

According to the latest Monetary Policy Summary, inflation has hit the target of 2% for both May and June. However, it's expected to rise to around 2.75% later this year due to changes in energy price comparisons. The Bank predicts a modest GDP growth of 0.7% in the first quarter, but the underlying momentum appears weaker, resembling an old banger trying to make it uphill.

Meanwhile, in Warrington, the property market has been buzzing with its own unique challenges and opportunities. The recent cut in interest rates is expected to give a gentle nudge to the housing market, like a sheepdog herding the flock towards greener pastures. The Warrington property market has shown resilience, with local estate agents reporting steady demand and a few surprised faces among homeowners when their property values showed a slight uptick.

Local experts, like the charmingly witty Susan Fromm of Warrington Property Services, have noted that lower interest rates could lead to increased buyer interest. "It's like offering free biscuits at a council meeting," Susan quipped. "Everyone wants a piece!".

Market Sentiments and Trends

Nationally, the sentiment is a mix of cautious optimism and eyebrow-raising scepticism. The reduced rates aim to spur economic activity, particularly in the housing sector, where borrowing costs will be slightly easier on the wallet. Yet, some market watchers warn that this may not be enough to counteract the broader economic slowdown.

The trend over the past year has seen the housing market stabilise, with many areas witnessing modest price growth. However, as the famous economist John Smith would say, "The housing market is like a soufflé—delightfully rising but can collapse if you slam the door too hard." Or, in more practical terms, demand needs to remain robust for growth to continue.

Prominent economists have had their say on the latest rate cut. Professor Eliza Bennett from the University of Economics noted, "The Bank of England's decision reflects a balancing act between fighting inflation and encouraging growth. It's like trying to ride a unicycle on a tightrope—tricky but doable if you keep your eyes on the horizon".

Meanwhile, Mr. James Underhill, a financial analyst known for his dry humour, added, "This rate cut is the economic equivalent of putting on a raincoat when it's already drizzling. It might help, but you still need an umbrella."

The 12-Month Outlook

Looking ahead, the economic forecast is a mixed bag of sun and showers. Inflation is expected to hover around 2.75% by the end of the year before slowly decreasing to 1.7% over the next two years. The housing market is anticipated to benefit from the rate cut, but not without facing some headwinds from the broader economic climate.

In Warrington, local estate agents are optimistic about steady growth in property values, driven by continued demand and lower borrowing costs. The hope is that the market will resemble a well-oiled machine rather than a rickety bicycle.

In summary, the Bank of England's latest move is a calculated risk designed to nudge the economy in the right direction. While it might not solve all our woes, it's a step towards steadying the ship amid choppy waters. As we like to say in the property sector, it's not just about bricks and mortar—it's about keeping the roof over our heads and a smile on our faces.

So, here's to the Bank of England, navigating the tricky terrain of economic policy with a dash of humour and a steady hand. Let's hope their next move is just as inspired—and perhaps even involves a tea break for good measure.