Hello there, property enthusiasts! Gather around as we delve into the fascinating world of property prices, both nationally and locally in our beloved Warrington. Buckle up, because while the figures might seem dry, we're here to make them sizzle with a dash of humour and a sprinkle of insight!

National Property Market:

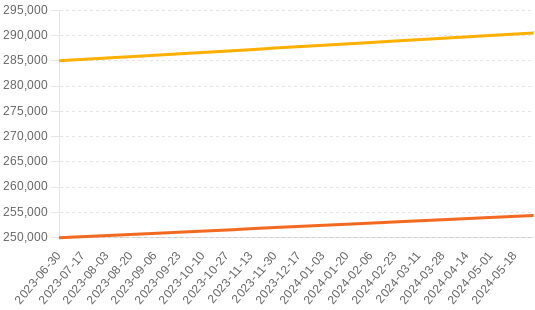

Let's start with the big picture. Over the past 12 months, the UK property market has been a rollercoaster, and not the fun kind you find at Blackpool Pleasure Beach. According to the latest Halifax House Price Index, the average UK house price has been steadily climbing, reaching an eye-watering £291,000 in May 2024. That's up from £285,000 in June 2023. If you're feeling a bit faint, grab a cuppa – it only gets more interesting!

Industry experts have been vocal about this upward trend. Russell Galley, Managing Director of Halifax, noted, "The UK housing market continues to be supported by a robust jobs market and low interest rates, but affordability remains a key issue." In plain English: people have jobs and can borrow money cheaply, but buying a house is still like trying to win the lottery.

Local Market in Warrington:

Now, let's zoom in on Warrington. Our local market has seen some spirited activity. Over the last year, the average house price in Warrington has risen from £250,000 to £254,000. That's a modest but significant increase, especially for those eyeing their equity with dreams of Mediterranean cruises or simply upgrading to a bigger garden for the dog.

What's driving this growth? Local estate agents like ourselves at Hamlet Homes can attest to a surge in demand. Warrington is increasingly attractive for its blend of urban convenience and charming countryside. Plus, the recent improvements in local amenities and transport links have made it even more appealing.

Market Sentiments and Trends:

Nationally, the sentiment is a mix of cautious optimism and mild panic. The UK's housing market remains buoyant, thanks to a resilient economy and a shortage of homes. However, the ever-present spectre of interest rate hikes and the cost-of-living crisis are keeping both buyers and sellers on their toes.

In Warrington, the mood is slightly more upbeat. The town is riding a wave of development and investment, which bodes well for continued growth. Local buyers are motivated, and the demand for rental properties is robust, driven by professionals seeking a balance between work and quality of life.

12-Month Outlook:

Looking ahead, the crystal ball shows a cautiously optimistic forecast. Nationally, house prices are expected to keep inching upwards, though at a slower pace. Halifax predicts that while growth will continue, the rate may moderate as the market adjusts to economic realities.

For Warrington, the outlook is sunny with a chance of even more growth. The local market is poised to benefit from ongoing developments and a strong community spirit. Our forecast suggests that Warrington house prices could climb to around £260,000 by mid-2025, reflecting sustained demand and the town's growing appeal.

In summary, the property market is as dynamic as ever. Nationally, prices are climbing, albeit at a more measured pace. Locally, Warrington is flourishing, offering opportunities for both buyers and investors. Whether you're looking to buy, sell, or simply stay informed, it's an exciting time to be involved in the property market.

Remember, property is not just about bricks and mortar – it's about dreams, futures, and a little bit of luck. So, keep an eye on those graphs, stay informed, and let's navigate this market with a smile and a sense of adventure.

Happy house hunting, Warrington!